Hong Kong galleries thrive despite lockdowns and crackdowns

Dealers were expanding old spaces and opening new ones as the city’s art market surpassed London’s

Primrose Riordan in Hong Kong MARCH 16 2023

Opening a gallery in Hong Kong early last year seemed unwise. At the time, the former British colony was reeling from the world’s deadliest Covid outbreak, and a now-scrapped weeks-long quarantine inspired an exodus of residents. The gloom, heightened by the city’s isolation from the rest of the world thanks to a ban on travellers as well as an ongoing political crackdown, felt immovable and endless.

But Fiona Ho and Natalie Ng, founders of new gallery Odds and Ends, which opened in April 2022, forged ahead. “I always see opportunities in risk . . . Because of the pandemic rent became low, and in PMQ [a mixed-use arts and design venue in Central] they had a programme of giving economical rents and more friendly rent for incubators,” says Ho, adding that collector interest has remained strong. The gallery is preparing to show local artist Sammi Mak’s paintings at this year’s Art Central. “With the rise of commercial market in Hong Kong there is also a rise in alternative art spaces,” says Ho.

Commercial galleries in Hong Kong have managed to expand despite strict pandemic rules effectively cutting off the Asian financial centre for the past three years. In the lead-up to one of Asia’s biggest art fairs, with 177 exhibitors, gallerists say that while they have cut their number of shows and lost staff, sales have still been strong.

“Hong Kong still has the highest concentration of money compared to anywhere else,” says Amanda Hon, managing director of Ben Brown Fine Arts in Hong Kong. “Many galleries, like myself, have expanded during these [past few] years or opened up second spaces.” Ben Brown went from a 1,000 sq ft space to a 5,600 sq ft gallery in Wong Chuk Hang during this period.

The city has faced a cavalcade of challenges over the past few years, with a political crackdown tearing at its civic fibre and tough pandemic restrictions undermining its status as a financial hub. Social gathering rules hampered public events and the three-week quarantine it imposed at one point caused some residents to flee for other Asian capitals.

Katie de Tilly, a Hong Kong arts scene veteran, said her 10 Chancery Lane Gallery went down from six to three staff during the period, but managed to increase its profits. “I was quite surprised: we put on fewer shows [but] still had very strong sales, I was expecting to hunker down,” says de Tilly. “We had less costs and the sales carried us through.”

In another sign of strong buyer interest in the Chinese territory — despite its isolation — Hong Kong overtook London as the world’s second largest auction centre in 2020, according to the government. Hong Kong’s share of auction sales rose to 23.2 per cent that year compared to London’s 22.7 per cent. The total trade value of artworks, collectors’ pieces and antiques was HK$66.6bn (US$8.48bn), four times the market’s worth in 2017.

The territory imposes no sales tax, value added taxes or import taxes on art works. “It is a competitive place with our tax advantage and our neighbour next door, China, with its growing wealth,” de Tilly adds.

Previously Asia’s dominant art hub, however, Hong Kong has witnessed other regional cities build a strong scene as it remained isolated from the world during Covid. Last year South Korea hosted Frieze’s first Asia edition in Seoul with more than 100 galleries. “The whole world felt like it was there, it was really booming,” de Tilly says.

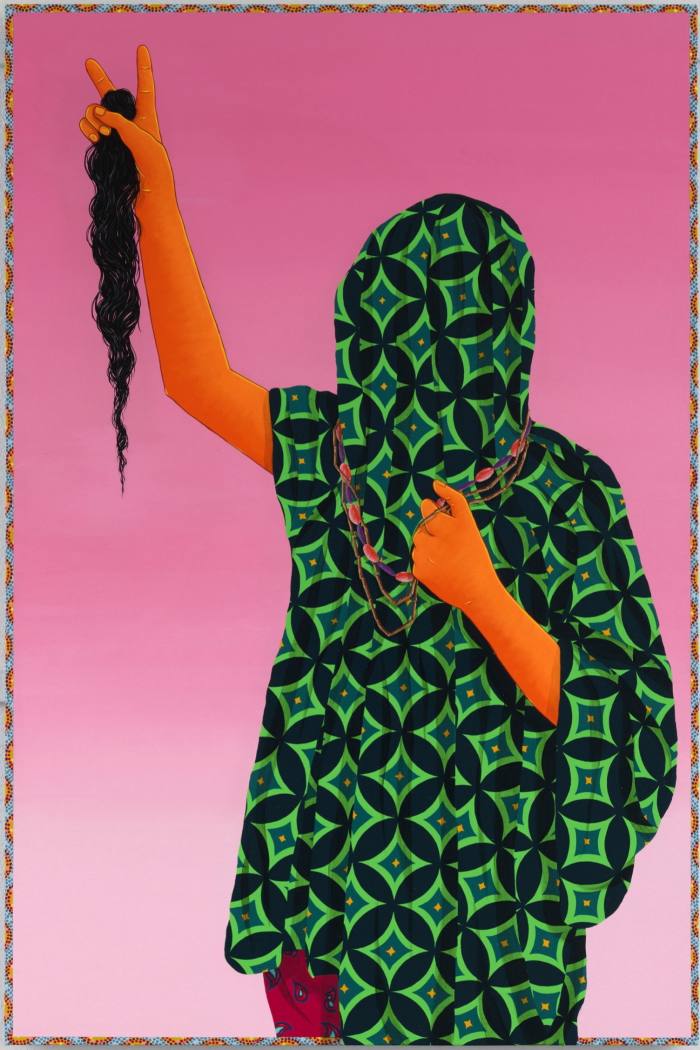

Two pieces from 2023 by Amir H Fallah at Denny Gallery

Two pieces from 2023 by Amir H Fallah at Denny Gallery

Hong Kong’s reputation as an arts centre was also damaged by the suppression of freedom of expression after it introduced a sweeping national security law in 2020. Several political cartoonists, including Ah To, fled the city, after facing attacks from pro-government media, while Kacey Wong, a performance artist and Tony Lau, a manga artist, left for Taiwan citing the introduction of the new law.

Katie Alice Fitz Gerald opened the Hong Kong branch of New York’s Denny Gallery in 2019, just as the city was hit by protests against a proposed extradition bill, then the pandemic. She held a major show of Iranian-American artist Amir H Fallah’s works there at the height of the city’s Omicron outbreak, when the government imposed its toughest social distancing restrictions.

“It was really in the thick of things, but we felt like there is a real enthusiasm . . . It was a heartening experience,” Fitz Gerald says. “It’s been volatile but I think having spent time living in Hong Kong, there is a big art market here and an enthusiasm for art.” Denny Gallery will hold a solo exhibition by Fallah, known for his elaborate murals and portraiture, at this year’s Art Basel.

Other galleries too have opened during the city’s tougher years. Ysabelle Cheung and Willem Molesworth set up their Property Holdings Development Group space in Causeway Bay in 2022. And a long-awaited institution, M+, one of Asia’s largest art museums, finally opened in 2021.

Another factor driving the scene is interest from the real estate sector, according to Odds and Ends’ Fiona Ho and Natalie Ng. “Corporate offices, hotels, private clubs . . . malls are looking not just for decorative art, they want a conversation piece,” says Ho. “There is an increased appetite for fine art that benefits us a lot.”