“Where Do Banks Go When They Die?”

By Seph Rodney, on September 29, 2016

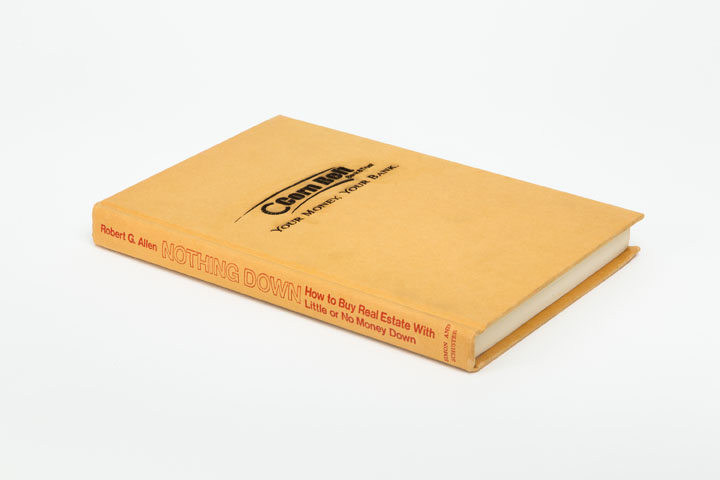

Did you know that since the start of the last recession that over 527 banks have failed? How would we know? When a bank fails there’s no dying cry, no elegy written for it, no sense that it leaves a hole in the community where it once was. Where does a bank go when it dies? During the process when a bank is absorbed by United States Federal Deposit Insurance Corporation (FDIC) the FDIC posts a notice on the defunct bank’s website along with a logo with which the institution was associated. Soon after, they are erased from the web. It took Michael Mandiberg eight years of collecting the tiny, pixelated logos from the FDIC public notices, painstakingly transforming them into vector files that could be read by a laser cutter, collecting financial books, that like these forlorn financial institutions had been discarded and abandoned, and incising the recovered, rehabilitated logos onto their covers.

For his exhibition FDIC Insured Mandiberg, along with several helpers who assisted him throughout the project, have assembled 527 of these books with all the matching institutional emblems resurrected and laser cut into the covers of old financial books on sale at either the Strand bookstore or through libraries, according to Mandiberg “at the lowest exchange value possible,” that is, no more than one dollar. Making the metaphorical circle fully complete, the work will be displayed on Rector Street, in Manhattan’s financial district.

Michael Mandiberg, “FDIC Insured (Corn Belt Bank and Trust, Pittsfield IL, February 13, 2009)” (2009-2010) Lasercut Found Book

Michael Mandiberg, “FDIC Insured (Corn Belt Bank and Trust, Pittsfield IL, February 13, 2009)” (2009-2010) Lasercut Found Book

The books are precisely the kind of failure of representation this exhibition requires. They only consist of incised logos on almost worthless books — no narrative or explanation of what the towns people did when their bank collapsed, no sense of the loss incurred when the institution that held their mortgages, cashed their checks, held their savings, vanished. They are left with the bitter dregs of late-capitalist ideology: a symbol that was supposed to last forever. This exhibition mirrors the transmutation of human labor into numbers on a ledger, financial instruments and complex schemes of valuation and investment. It all melts away and when we ask where it went, we are likely to receive a shrug or a bashful grin from some bureaucratic representative, and a version of “we don’t have that information.” FDIC Insured is also a mediation on how much modernity’s progress in abstracting human labor, human experience impoverishes us.

The story of the closing of a local bank, or even a large one, should be told with all the embarrassing, foundering details that — behind closed doors — probably preceded its collapse. With all that hidden, we are left with only the iconic references to something that had real substance. Unfortunately we live in a culture of binges and purges. As corporations we eat up undervalued assets, unregulated industries, vulnerable market segments, devouring profits at the expense of … whoever, until there is nothing left on the plate. But when we regurgitate the foreclosed houses and the abandoned city centers we try to hide the ugly aftereffects. If we could flush them down a municipal toilet we would. We devour reality videos that show us at our worst, our most abject, and we celebrate these moments of the debasement of others. But then when we lose our jobs, our livelihoods, we crawl into a dark corner, hide and self-medicate. In the United States we have not learned to deal honestly with ourselves because we have not figured out how to deal with our own desires and push away from the table, recognizing we are full. We’ve had enough.

FDIC Insured continues at the Art-in-Buildings Financial District Project Space (40 Rector Street, Suite 1500) in Manhattan’s financial district, through December 15.