MICHAEL MANDIBERG | SIMON DENNY by Ian Cofre The process of banks failing due to the subprime mortgage crisis greatly accelerated after Lehman Brothers declared bankruptcy on September 15, 2008. Facing systemic risk and contagion, the Federal Deposit Insurance Corporation (“FDIC”), a U.S. government organization, helmed the swift and ruthless effort to quarantine this plague. Eight years to the day from Lehman’s failure, artist and educator Michael Mandiberg debuted his current exhibition, FDIC Insured, which captures the extent of this…Read More

Michael Mandiberg: FDIC Insured By R.C. Baker You’ve seen it: the bright bank logo on a storefront you pass every day that one morning has morphed into a different bank’s emblem. Like an ocean’s surface, American capitalism spreads as far as the eye can see, but mysterious and treacherous currents roil its depths. Since 2008, when the financial industry most recently reaped the whirlwind, artist Michael Mandiberg has been collecting the logos of failed banks for his “FDIC Insured” project —…Read More

Art of Failure Bloomberg Businessweek September 26 – October 2, 2016 Issue

“Where Do Banks Go When They Die?” By Seph Rodney, on September 29, 2016 Did you know that since the start of the last recession that over 527 banks have failed? How would we know? When a bank fails there’s no dying cry, no elegy written for it, no sense that it leaves a hole in the community where it once was. Where does a bank go when it dies? During the process when a bank is absorbed by United…Read More

“Making Art with Failed Banks” By Mark Singer in the September 26, 2016 Issue Michael Mandiberg, an artist whose preoccupations merge digital information with visual representation, has a lot going on. This was also the case eight years ago, when he lived in Brooklyn (Prospect Heights, still does) and was a senior fellow at Eyebeam, a nonprofit that supports artists immersed in technology and playful technologists. “I was noticing that people were giving away books, streeting them, leaving them on…Read More

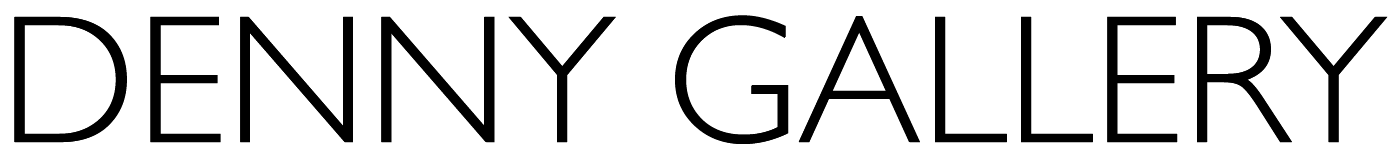

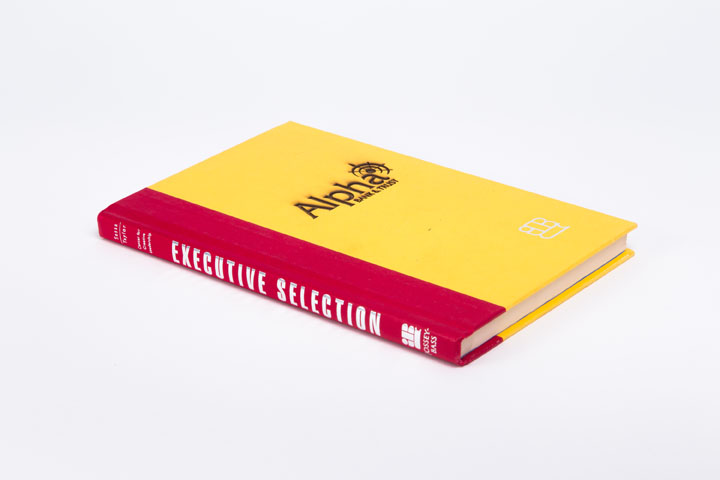

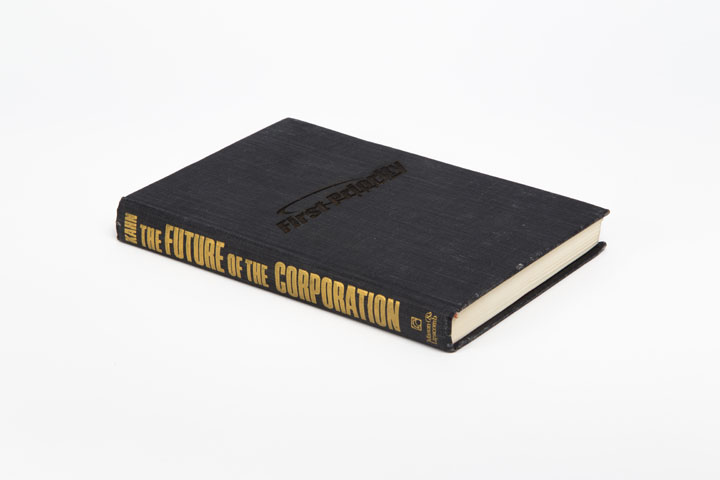

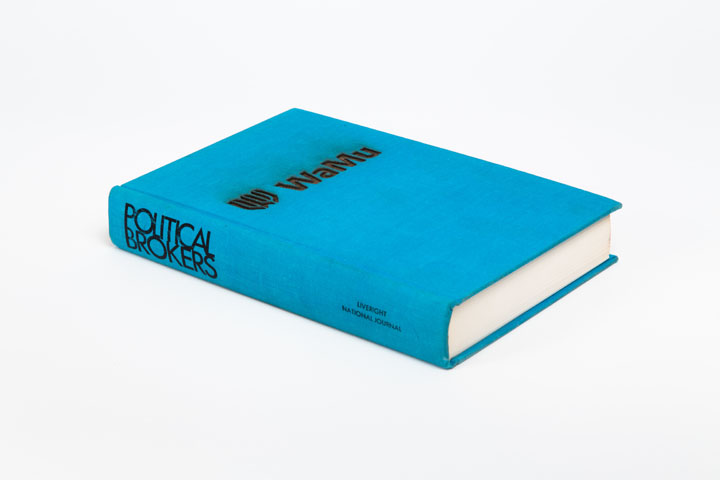

“Go for Broke: Cataloguing failure, one bank at a time” By Juliet Helmke | September 15, 2016 “527 is the correct number, a few more failed since info about the project came out,” says artist Michael Mandiberg, counting the number of books that make up his upcoming, site-specific installation “FDIC Insured.” All are cast off investment guidebooks that the artist has repurposed, laser printing their covers with the logo of a US bank that has officially “failed”—meaning it was forced to…Read More

“ArtRx NYC” By Jillian Steinhauer on September 13, 2016 This week is all about books, as Printed Matter’s beloved art book fair touches down in Long Island City, while a new satellite fair pops up in nearby Greenpoint. Plus, don’t miss the celebration of a pioneering performance series and the first retrospective for maintenance artist Mierle Laderman Ukeles. The FDIC’s Failed Banks When: Opens Thursday, September 15, 6–8pm Where: Art-in-Buildings Financial District Project Space (40 Rector Street, Financial District, Manhattan) Michael Mandiberg, “FDIC Insured (First Priority, Bradenton FL,…Read More

Market Research: An Interview with Michael Mandiberg By Tina Rivers Ryan The 2008 recession drew attention to the destabilization of financial markets by a banking sector that skirts the edges of regulation, using purposely inscrutable financial instruments. In response, a number of artists have attempted to represent the social, political, and financial networks that comprise contemporary capitalism. Around the time of the crisis, artist Michael Mandiberg began collecting discarded self-help financial books of the more optimistic recent past, along with…Read More

Don’t bank on it: New York artist’s memorial to financial failures comes to Wall Street Michael Mandiberg has recorded the logos of more than 500 banks that closed during the recession for his installation FDIC Insured Julia Halperin 9 May 2016 For six and a half years, from the height of the recession in 2009, the New York-based artist Michael Mandiberg woke up every Saturday, turned on his computer and discovered which US banks had failed that week. Then, he…Read More